| ■ |

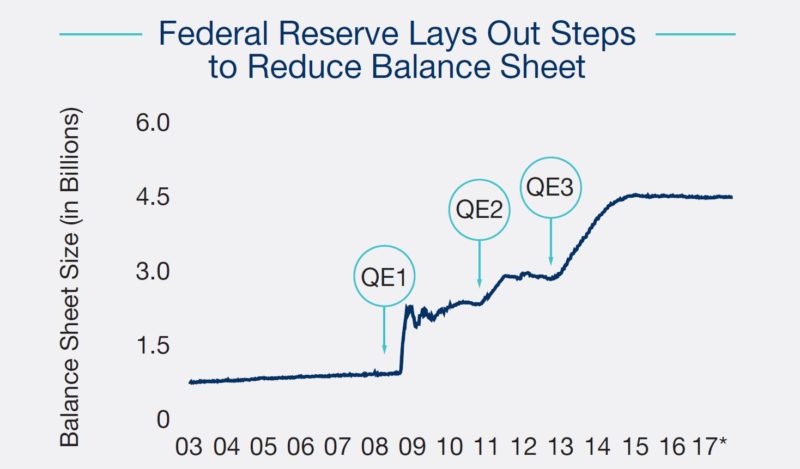

The Fed balance sheet reduction will place upward pressure on long-term interest rates, which have been range-bound in recent months. Foreign investment in U.S. Treasurys could partially offset this movement. |

| ■ |

The Fed will closely monitor the yield spread between long- and short-term rates, a key indicator of an impending recession. |

| ■ |

Commercial real estate yields still offer a premium over the Treasury rates, but the spread could tighten as interest rates rise. Investor caution remains elevated, moderating transaction activity, but the flow of capital to the sector is still elevated by historical standards. |

|