Special Report: Emerging Trends

Executive Summary

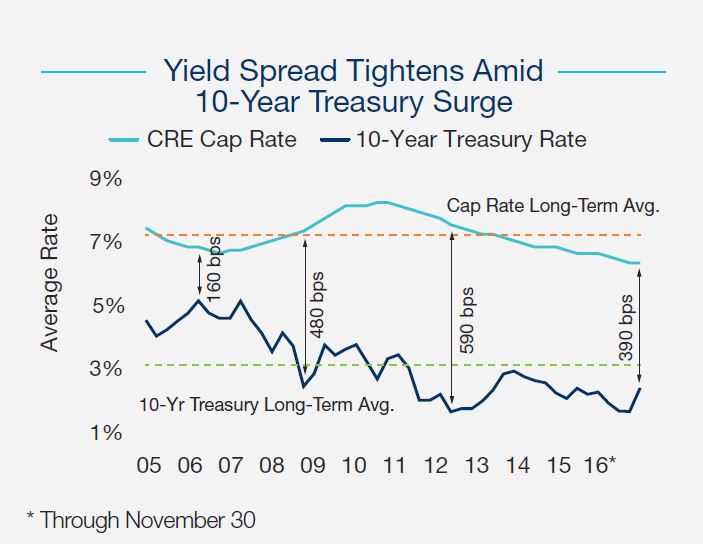

• A sharp increase in the yield on the 10-year U.S. Treasury, along with expectations of changes to the tax code in 2017, encouraged many investors to reassess their strategies. The shifting landscape will likely reduce transaction activity in the fourth quarter compared with 2015.

• Even assets in secondary and tertiary markets have faced renegotiation as the rising cost of capital forced many to recalibrate their yield expectations and reconsider closing, widening the bid/ask spread.

• Liquidity remains in commercial real estate capital markets, although the rise in the 10-year U.S. Treasury will increase rates for borrowers. Overall, lenders are exercising more caution and tightening LTVs.

• The Federal Reserve will continue to monitor the impact of new fiscal policies and could make more frequent and aggressive rate increases.

• A strengthened economic outlook and positive performance outlook will support long-term commercial real estate investor demand.

FULL REPORT: Emerging Trends 4Q16 Transaction Pullback